Rumored Buzz on Stonewell Bookkeeping

Table of ContentsSome Known Details About Stonewell Bookkeeping Some Known Details About Stonewell Bookkeeping Not known Factual Statements About Stonewell Bookkeeping Unknown Facts About Stonewell BookkeepingThe 7-Minute Rule for Stonewell Bookkeeping

Right here, we address the inquiry, exactly how does bookkeeping assist a company? Real state of a firm's funds and money flow is constantly in flux. In a feeling, accountancy books stand for a photo in time, yet only if they are upgraded frequently. If a business is taking in bit, a proprietor needs to take activity to enhance earnings.

None of these verdicts are made in a vacuum as valid numeric details need to copyright the financial choices of every little business. Such information is compiled through bookkeeping.

You know the funds that are offered and where they drop short. The news is not constantly good, however at the very least you recognize it.

Some Ideas on Stonewell Bookkeeping You Should Know

The maze of reductions, credit ratings, exceptions, timetables, and, naturally, charges, suffices to merely surrender to the IRS, without a body of efficient paperwork to support your insurance claims. This is why a specialized bookkeeper is very useful to a small business and is worth his/her king's ransom.

Those philanthropic payments are all enumerated and accompanied by details on the charity and its payment details. Having this info in order and close at hand allows you file your income tax return with ease. Remember, the federal government does not fool around when it's time to file tax obligations. To be sure, a company can do whatever right and still go through an internal revenue service audit, as lots of already understand.

Your organization return makes insurance claims and representations and the audit focuses on validating them (https://efficient-sunflower-srfv7n.mystrikingly.com/blog/bookkeeping-your-business-s-secret-weapon-for-financial-success). Excellent accounting is all about linking the dots in between those representations and truth (Accounting). When auditors can follow the info on a journal to invoices, financial institution declarations, and pay stubs, among others documents, they rapidly discover of the expertise and honesty of business organization

Not known Factual Statements About Stonewell Bookkeeping

Similarly, careless bookkeeping includes in stress and stress and anxiety, it likewise blinds local business owner's to the possible they can understand over time. Without the information to see where you are, you are hard-pressed to set a destination. Only with easy to understand, detailed, and accurate information can an organization proprietor or monitoring group story a course for future success.

Organization proprietors know finest whether an accountant, accountant, or both, is the right solution. Both make vital payments to a company, though they are not the exact same occupation. Whereas a bookkeeper can collect and organize the information required to support tax obligation prep work, an accounting professional is better fit to prepare the return itself and truly examine the earnings statement.

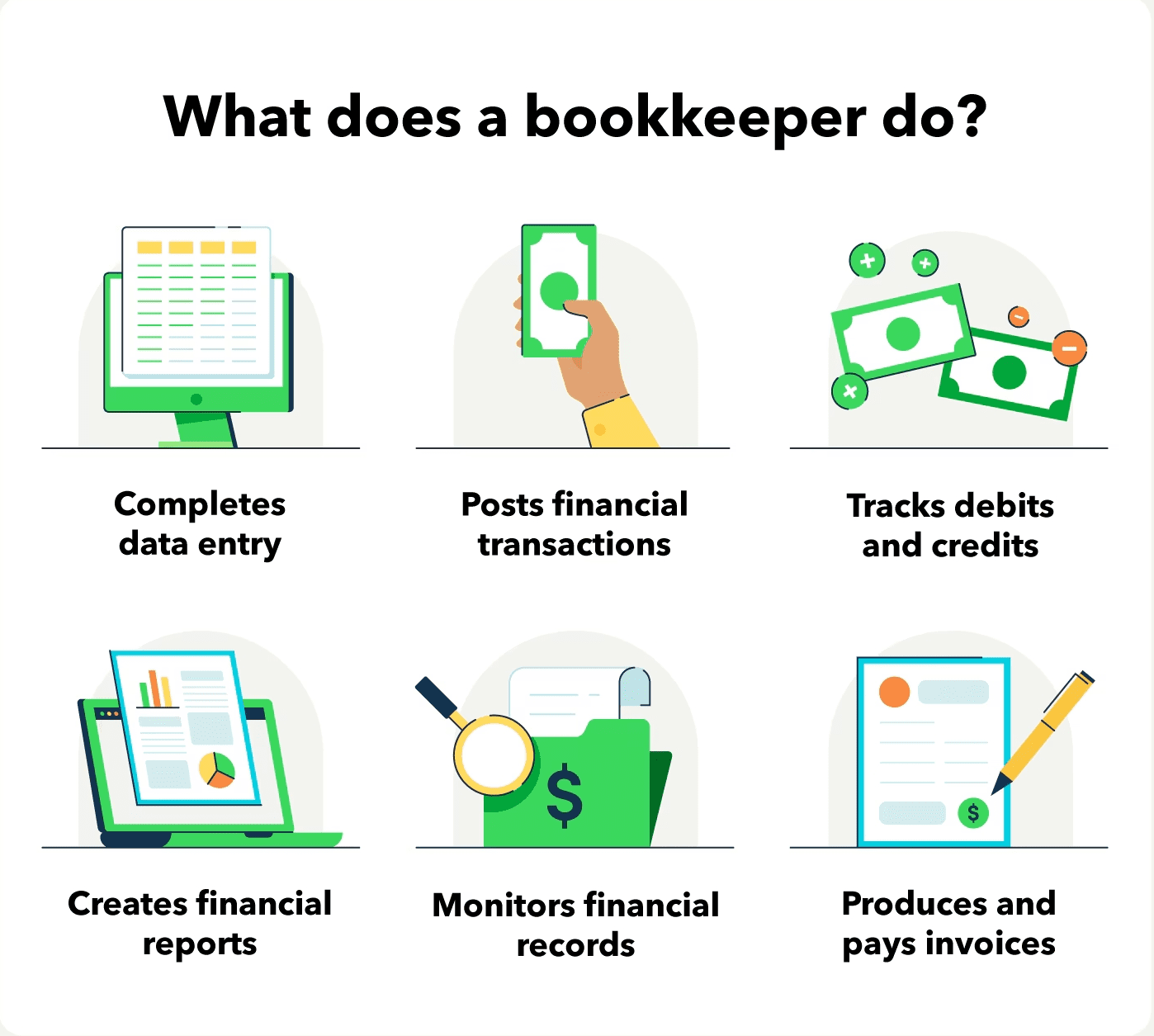

This post will dig right into the, consisting of the and just how it can benefit your service. Bookkeeping includes recording and organizing financial deals, including sales, acquisitions, settlements, and receipts.

By routinely upgrading monetary documents, bookkeeping aids organizations. This assists in quickly r and saves organizations from the tension of looking for papers throughout due dates.

The Greatest Guide To Stonewell Bookkeeping

They likewise want to know what capacity the service has. These aspects can be easily handled with accounting.

Therefore, accounting assists to prevent the headaches connected with reporting to financiers. By maintaining a close eye on financial records, businesses can set realistic goals and track their progress. This, in turn, promotes better decision-making and faster company development. Government regulations typically require services to keep monetary documents. Routine accounting guarantees that companies remain compliant and prevent any penalties or legal issues.

Single-entry bookkeeping is straightforward and functions finest for local business with few transactions. It includes. This approach can be contrasted to keeping a simple checkbook. Nonetheless, it does not track assets and responsibilities, making it less thorough compared to double-entry see this website accounting. Double-entry bookkeeping, on the other hand, is much more sophisticated and is usually thought about the.

Unknown Facts About Stonewell Bookkeeping

This might be daily, weekly, or monthly, relying on your company's size and the volume of deals. Don't wait to seek aid from an accounting professional or bookkeeper if you find managing your monetary records testing. If you are trying to find a cost-free walkthrough with the Audit Option by KPI, call us today.